The $17,000 annual gift tax exclusion is calculated per recipient. Meaning, you can gift up to $17,000 per person to an unlimited number of individuals in any given year without triggering the gift tax. For gifts given by a married couple, the annual exclusion amount is $34,000 (twice the individual exclusion).

Can my parents give me $100 000?

Can my parents give me $100,000? Your parents can each give you up to $17,000 each in 2023 and it isn't taxed. However, any amount that exceeds that will need to be reported to the IRS by your parents and will count against their lifetime limit of $12.9 million.

Do I have to pay taxes on a $5000 gift?

At a glance:

You don't have to report gifts to the IRS unless the amount exceeds $17,000 in 2023. Any gifts exceeding $17,000 in a year must be reported and contribute to your lifetime exclusion amount. You can gift up to $12.92 million over your lifetime without paying a gift tax on it (as of 2023).

How much does IRS charge for gift tax?

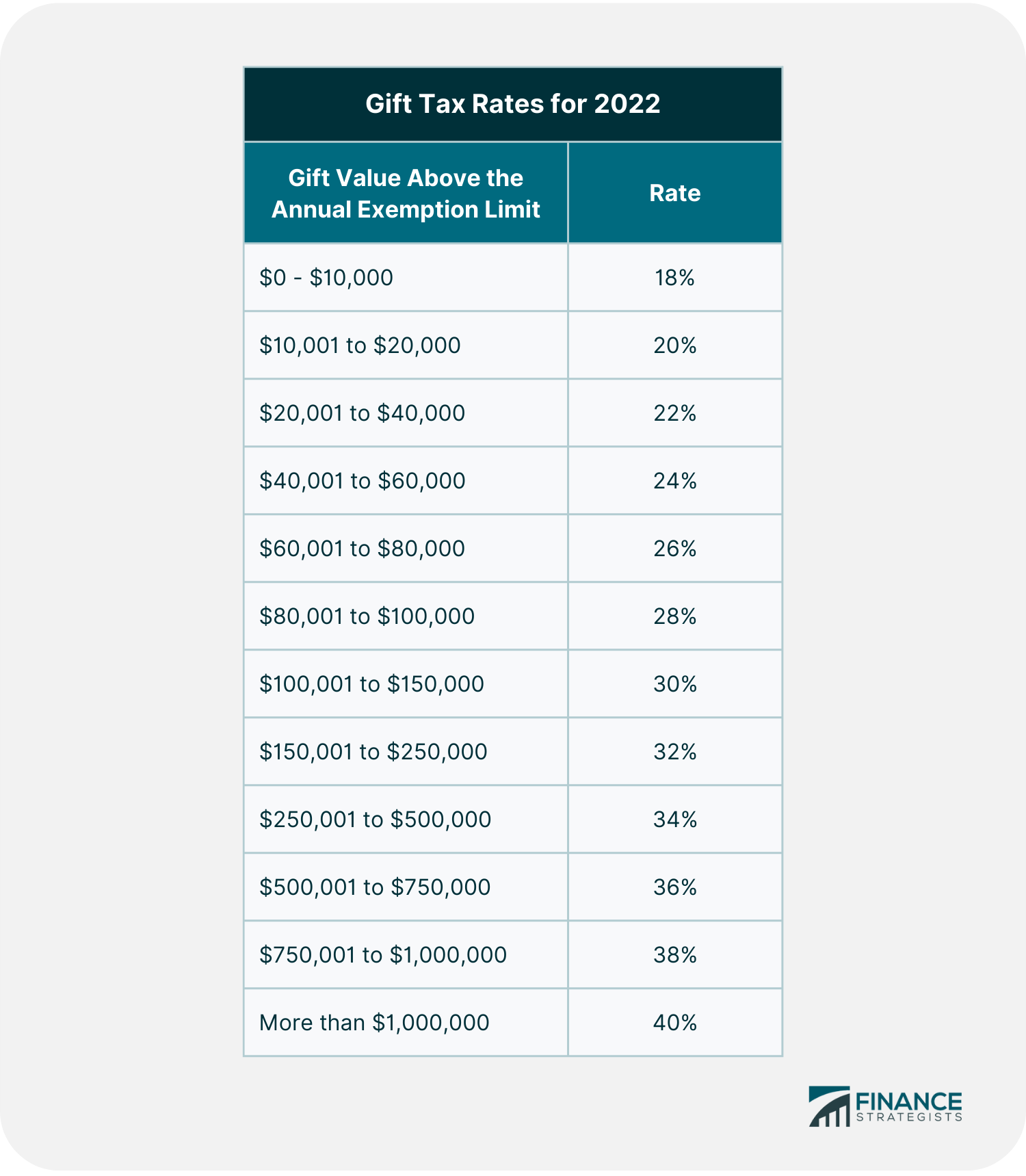

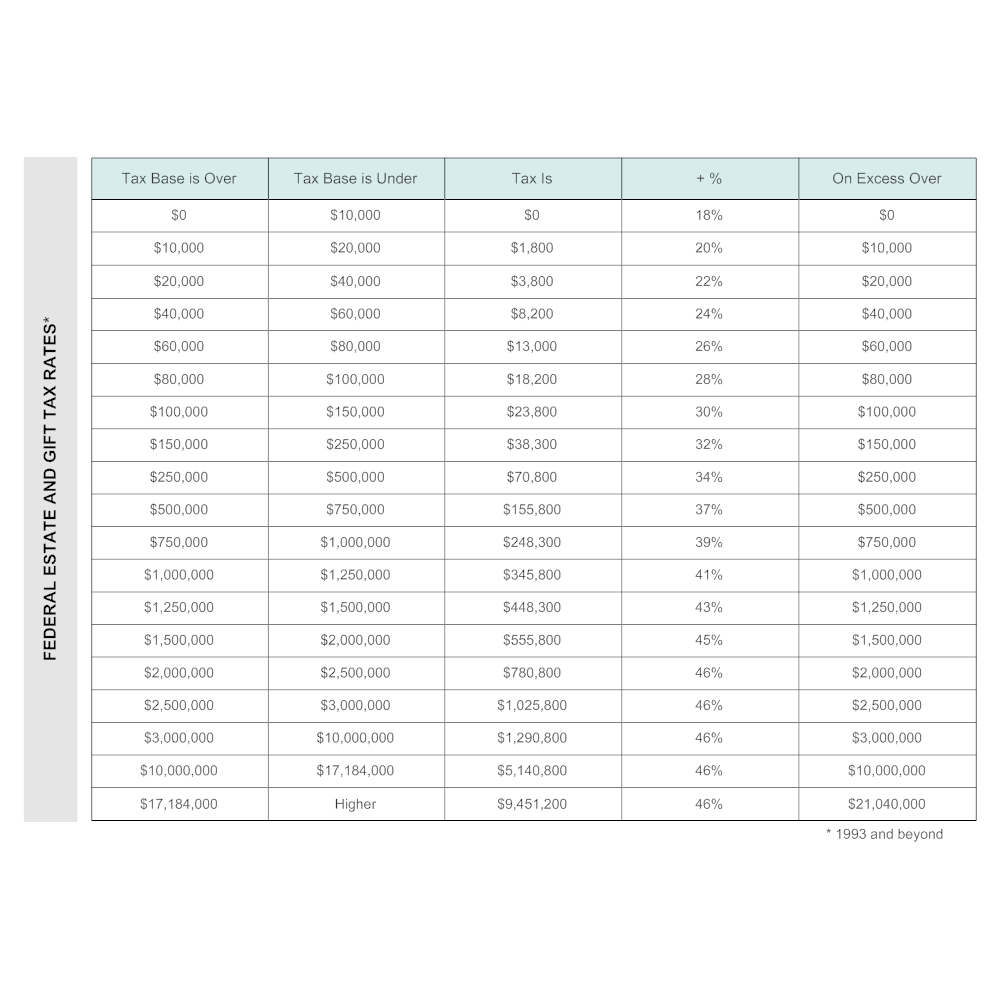

How much is the gift tax rate? Taxpayers typically only pay gift tax on the amounts that exceed the allotted lifetime exclusion, which is $12.92 million in 2023 and $13.61 million in 2024. Gift tax rates range from 18% to 40%. Internal Revenue Service.

Do I have to report gifted money as income?

Essentially, gifts are neither taxable nor deductible on your tax return.

How much money can be gifted tax free in Ohio?

The $17,000 annual gift tax exclusion is calculated per recipient. Meaning, you can gift up to $17,000 per person to an unlimited number of individuals in any given year without triggering the gift tax. For gifts given by a married couple, the annual exclusion amount is $34,000 (twice the individual exclusion).

Have you renewed your @OhioState #Nursing Alumni Society membership yet? If not, make a tax-deductible gift of $25 or more to any College of Nursing fund by December 31, 2017 to continue your membership benefits through 2018. https://t.co/ScmQu1akN5

— Ohio State Nursing (@osunursing) December 28, 2017

What is the gift tax limit for inheritance?

That's because the IRS allows you to give away up to $18,000 in 2024 and $17,000 in 2023 in money or property to as many people as you like each year. The government also exempts $13.61 million in 2024 and $12.92 million in 2023 in gifts from tax over a person's lifetime.

Frequently Asked Questions

How do I calculate gift tax?

Calculating the Gift Tax

To calculate the gift tax, you will need to determine the value of the gift and then find your marginal tax rate. The marginal tax rate for gifts is currently 40%. Below is a table showing the tax brackets for federal gift tax rates applicable for 2023.

How much money can you gift someone without paying taxes in Ohio?

$17,000

Ohio also has no gift tax, meaning the only gift tax that may apply to you is the federal gift tax. The gift tax exemption for 2022 was $16,000 per person per year. In 20223that increases to $17,000. Gifting more than that to a single person in one year will reduce your lifetime exemption of $12.92 million.

How does the IRS know if I give a gift?

If you've transferred money directly from your bank account in giving your gift, the IRS can find out about this. The IRS is generally unlikely to find out about a gift normally. However, if you get audited, the IRS will know. You could then be subject to penalties for not reporting the gift.

How much money can be gifted tax-free in Ohio?

The $17,000 annual gift tax exclusion is calculated per recipient. Meaning, you can gift up to $17,000 per person to an unlimited number of individuals in any given year without triggering the gift tax. For gifts given by a married couple, the annual exclusion amount is $34,000 (twice the individual exclusion).

FAQ

- How much money can you receive as a gift from family?

- The IRS allows every taxpayer is gift up to $17,000 to an individual recipient in one year. There is no limit to the number of recipients you can give a gift to. There is also a lifetime exemption of $12.92 million.

- How much money can a person receive as a gift without being taxed in 2023?

- $17,000 What is the annual gift tax limit for 2023? The tax-free gift limit (gift tax exclusion) for 2023 is $17,000 (it was $16,000 in 2022). As a result, you can give up to $17,000 to as many people as you want in 2023 without having to worry about paying the federal gift tax.

- What is the maximum gift amount to a family member?

- The IRS allows every taxpayer is gift up to $18,000 to an individual recipient in one year. There is no limit to the number of recipients you can give a gift to. There is also a lifetime exemption of $13.61 million.

- What is the maximum gift you can receive without paying taxes?

- Gift tax limit 2023 The 2023 gift tax limit is $17,000. For married couples, the limit is $17,000 each, for a total of $34,000. This amount, formally called the annual gift tax exclusion, is the maximum amount you can give a single person without reporting it to the IRS.

How much is gift tax in ohio

| How does IRS know if you gift money? | The primary way the IRS becomes aware of gifts is when you report them on form 709. You are required to report gifts to an individual over $17,000 on this form. This is how the IRS will generally become aware of a gift. |

| How much money can a person receive as a gift without having to pay taxes? | Do I have to pay taxes on a $20,000 gift? You do not need to file a gift tax return or pay gift taxes if your gift is under the annual gift tax exclusion amount per person ($17,000 in 2023). If you do exceed that amount, you don't necessarily need to pay the gift tax. |

| Can I gift a family member money without being taxed? | The IRS allows every taxpayer is gift up to $17,000 to an individual recipient in one year. There is no limit to the number of recipients you can give a gift to. There is also a lifetime exemption of $12.92 million. |

| What is the maximum non taxable gift to family? | You can give up to the annual exclusion amount ($17,000 in 2023) to any number of people every year, without facing any gift taxes or filing a gift tax return. If you give more than $17,000 in 2023 to someone in one year, you do not automatically have to pay a gift tax on the overage. |

- How can I transfer a large monetary gift to a family without being taxed?

- 6 Tips to Avoid Paying Tax on Gifts

- Respect the annual gift tax limit.

- Take advantage of the lifetime gift tax exclusion.

- Spread a gift out between years.

- Leverage marriage in giving gifts.

- Provide a gift directly for medical expenses.

- Provide a gift directly for education expenses.

- Consider gifting appreciated assets.

- 6 Tips to Avoid Paying Tax on Gifts

- How much of the gift is subject to federal gift taxes?

- The gift tax limit is $17,000 in 2023 and $18,000 in 2024. The gift tax rate ranges from 18% to 40%. The gift giver is the one who generally pays the tax, not the receiver.

- How much money can be gifted to a family member without being taxed?

- The basic gift tax exclusion or exemption is the amount you can give each year to one person and not worry about being taxed. The gift tax exclusion limit for 2022 was $16,000, and for 2023 it's $17,000. That means anything you give under that amount is not taxable and does not have to be reported to the IRS.

- How do I avoid gift tax?

- 6 Tips to Avoid Paying Tax on Gifts

- Respect the annual gift tax limit.

- Take advantage of the lifetime gift tax exclusion.

- Spread a gift out between years.

- Leverage marriage in giving gifts.

- Provide a gift directly for medical expenses.

- Provide a gift directly for education expenses.

- Consider gifting appreciated assets.

- 6 Tips to Avoid Paying Tax on Gifts