Title: How Do I Gift a Car to Someone in Florida? A Comprehensive Guide

Meta description: Planning to gift a car to someone in Florida? Read this comprehensive guide to understand the process, requirements, and legalities involved in gifting a car in the Sunshine State.

Introduction:

Gifting a car to someone can be an incredibly thoughtful and generous gesture. However, the process of gifting a car involves several legalities and documentation, which vary from state to state. If you're wondering how to gift a car to someone in Florida, you've come to the right place. This article will provide you with a step-by-step guide to ensure a smooth and hassle-free car gifting experience.

#1 Understanding the Process of Gifting a Car in Florida:

Gifting a car in Florida requires the completion of specific steps and documentation. Here's an overview of the process:

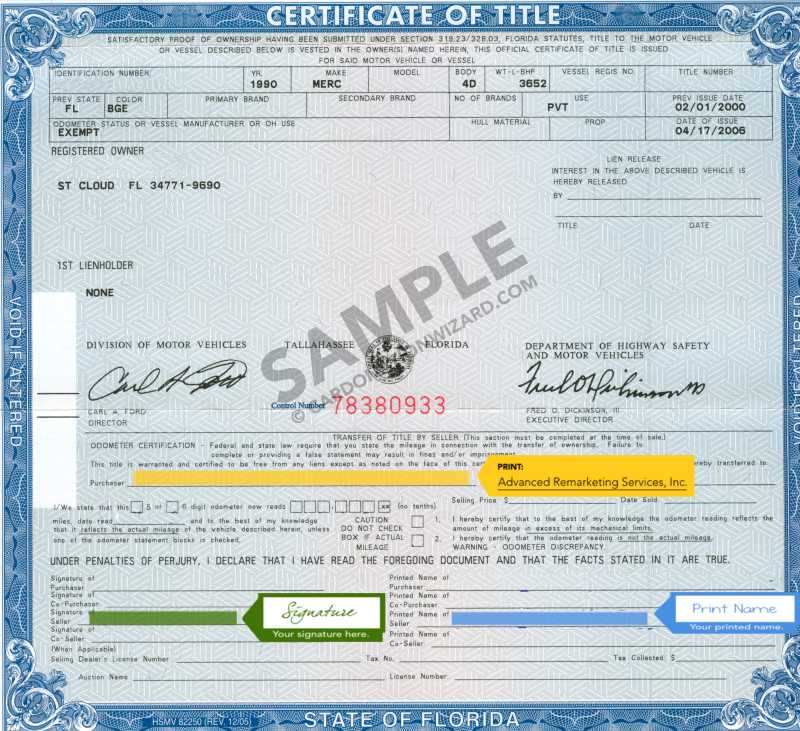

1. Obtain the Car's Title: Before proceeding with the gift, ensure that you have the car's title in your possession. The title should be free of any liens or outstanding loans.

2. Fill out the Title Transfer Section: On the back of the title, fill out the section for transferring ownership. Include the recipient's name and address as the new owner.

3. Provide a Gift

How do I transfer a car title to my daughter in Florida?

One way to do it is to go to their local FL DMV with you, the gift-giver, wait in line and fill out the paperwork there including a Certificate of Title. There will be title fees and registration fees, because now the car will be under new ownership. There will be no sales tax because the vehicle is a gift.

Do I have to pay taxes on a car that was gifted to me in Florida?

If you live in Florida and you gift a car to a family member, a bill of sale gift or affidavit will exempt you from taxes. If you do have to pay taxes on your gifted vehicle, the state uses the vehicle's fair market value to calculate the amount you have to pay.

Can you transfer a title online in Florida?

How To Transfer A Car Title In Florida. In case of private sell or purchase of a vehicle, you can easily complete your title transfer online with eTags, without ever having to wait in line or make an appointment. A transfer of ownership is also needed in the case of a move to Florida.

Do both parties need to be present to transfer a title in FL?

If the title is held electronically, the seller and buyer must visit a motor vehicle service center to complete a secure title reassignment (HSMV 82994 or 82092) and disclose the odometer reading. The buyer and seller must both be present and provide photo identification.

How much does it cost to transfer a car title to a family member in Florida?

Motor Vehicle Title Fees

| Original New | $77.25 |

|---|---|

| Original Used | $85.25 |

| Transfer/Duplicate | $75.25 |

| Lien Only (No transfer of ownership) | $74.25 |

| Fast Title | $10.00 |

Kind stranger leaves note and gift on Hurricane Florence evacuee's car: 'Florida is praying for you and your state' https://t.co/BYMOynTpYy pic.twitter.com/7DhxDZBd0G

— Yahoo (@Yahoo) September 18, 2018

How do I avoid paying tax on a gifted car in Florida?

If you live in Florida and you gift a car to a family member, a bill of sale gift or affidavit will exempt you from taxes. If you do have to pay taxes on your gifted vehicle, the state uses the vehicle's fair market value to calculate the amount you have to pay.

Frequently Asked Questions

What are the rules for gifting a car in Florida?

If you are gifting someone a car in Florida, treat the title transfer of the vehicle as if you were selling the vehicle. Florida requires that all title transfers include the certificate of title, bill of sale, title and registration fees, and the Florida Insurance Affidavit (Form HSMV 83330).

Do I have to pay sales tax when I transfer my car to Florida?

If the vehicle was titled in the applicants name for more than 6 months prior to taking title in Florida, no sales tax is due. If the vehicle is coming from another country a use tax in the amount of 6% will be collected on the fair market value of the vehicle.

Is it better to gift a car or sell for a dollar in Florida?

If you do have to pay taxes on your gifted vehicle, the state uses the vehicle's fair market value to calculate the amount you have to pay. While some car owners consider selling the car for a dollar instead of gifting it, the DMV gift car process is the recommended, not to mention more legitimate, way to go.

How much is gift tax on a vehicle Florida?

There's no gift tax rate in Florida. However, there is a federal gift tax rate of up to 40 percent levied on transfers.

Do both parties have to be present to transfer a car title in Florida?

If the title is held electronically, the seller and buyer must visit a motor vehicle service center to complete a secure title reassignment (HSMV 82994 or 82092) and disclose the odometer reading. The buyer and seller must both be present and provide photo identification.

FAQ

- How do I gift a car to my son in Florida?

- It is legal to give a car to a family member or anyone else, however, a bill of sale or an affidavit should be completed by both parties to verify this information for the Department of Revenue.

- How to give gift a vehicle in florida

- Sep 30, 2019 — One way to do it is to go to their local FL DMV with you, the gift-giver, wait in line and fill out the paperwork there including a Certificate

- Do you have to pay taxes on a vehicle that is gifted to you in Florida?

- If you live in Florida and you gift a car to a family member, a bill of sale gift or affidavit will exempt you from taxes. If you do have to pay taxes on your gifted vehicle, the state uses the vehicle's fair market value to calculate the amount you have to pay.

- How do I transfer ownership of a car to a family member in Florida?

- You need the following documents: the car title (and the complete transfer form on the back of the title), proof of insurance, vehicle registration, lien information, bill of sale, and money to cover the title fee and any other fees. Be sure to check with the DMV so you know what transfer fees to expect.

- What is the form for gifting a car in Florida?

- The Bill of Sale form HSMV 82050 includes sections for both the gift-giver/seller and gift recipient/purchaser. It also features spaces for the vehicle's details such as make/model, Certificate of Title (which proves that the gift-giver is the actual owner of the car being gifted) and more.

How to gift a car in florida

| How do you write a bill of sale for a gifted car in Florida? | How to Properly Draft a Bill of Sale for a Gifted Car?

|

| What documents do I need to gift a car in Florida? | It is legal to give a car to a family member or anyone else, however, a bill of sale or an affidavit should be completed by both parties to verify this information for the Department of Revenue. If the vehicle is purchased by joint ownership, why do both parties have to be present? |

| Is it better to gift a car or sell it for a dollar in Florida? | If you do have to pay taxes on your gifted vehicle, the state uses the vehicle's fair market value to calculate the amount you have to pay. While some car owners consider selling the car for a dollar instead of gifting it, the DMV gift car process is the recommended, not to mention more legitimate, way to go. |

| Is there a gift tax on cars in Florida? | Florida does not have a gift tax. |

| Do both owners have to be present to register a car in Florida? | The signatures of all owners need to be present on the form, and they will need to present proof of identity even if not there in person. You will have the option of registering the vehicle for either one year or two years. |

- Can you gift a tag in Florida?

- You can't transfer the plate to another person – they must get their own registration and plate. However, if you buy a new car (either from a dealer or another individual), you can save some money by transferring your existing plate to your new car.

- How do I gift a car to a family member in Florida?

- It is legal to give a car to a family member or anyone else, however, a bill of sale or an affidavit should be completed by both parties to verify this information for the Department of Revenue.

- Is it better to give a car or sell it for a dollar?

- Selling a vehicle for $1 instead of gifting it could result in your recipient paying sales tax based on the car's fair market value — it's better to stick with the official gifting process.

- Do you need a bill of sale for a gifted car in Florida?

- It is legal to give a car to a family member or anyone else, however, a bill of sale or an affidavit should be completed by both parties to verify this information for the Department of Revenue.

- Do you pay sales tax on gifted vehicle in Florida?

- One way to do it is to go to their local FL DMV with you, the gift-giver, wait in line and fill out the paperwork there including a Certificate of Title. There will be title fees and registration fees, because now the car will be under new ownership. There will be no sales tax because the vehicle is a gift.